Q4 fuel surcharges are over a third of trans-Pacific contract rates

Four years ago, before COVID-19 and the Ukraine-Russia conflict took over the news, people in the shipping business were mainly talking about how much it cost to fuel their ships. They were getting ready to follow a big global rule called IMO 2020. This rule said they had to use cleaner but pricier fuel called VLSFO (very low sulfur fuel oil), with less pollution. The problem was that this new fuel cost more money, and those extra costs would be passed on to the companies that shipped things and, eventually, to you as a consumer.

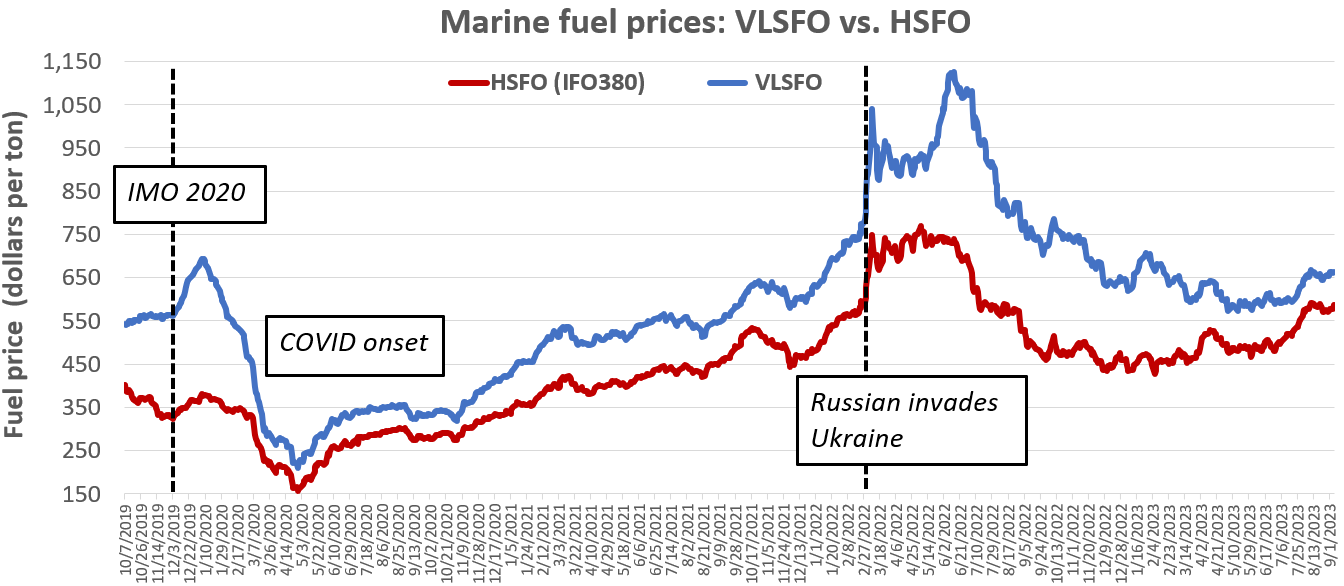

As expected, after IMO 2020 started on January 1, 2020, the price of fuel went up a lot. But then the COVID-19 pandemic hit, and everything changed. People needed less gas and diesel, so the price of oil went way down, and ship fuel got cheaper too. By the middle of 2020, ship fuel was 30% less expensive than before IMO 2020, and people worried less about the rules. In the second half of 2020 and all through 2021, fuel costs started going up again. However, by that time, the companies that ship stuff in containers had a bigger problem. The cost of moving goods in ships went up a lot because of problems in the supply chain. So, these companies had to use the super expensive spot market. Fuel costs went up, but they were a smaller part of the overall cost.

In 2022, when Russia invaded Ukraine, fuel costs went super high, but they later dropped as the world adjusted. However, even when fuel costs were high during the conflict, the rates companies paid to ship goods by sea stayed really high, and that made fuel costs seem less important. Now, ship fuel costs are going up again. The price of VLSFO is almost as high as it was right after IMO 2020 started. Companies are also charging more for fuel in their shipping contracts. But here’s the thing: the cost of moving goods by ship is back to where it was before COVID-19 and before IMO 2020. That means the part of the cost that comes from expensive VLSFO is now much bigger.

So, we’re back to worrying a lot about ship fuel costs, just like we were four years ago.

The cost of fuel for ships has gone up a few times recently, and it’s been higher than it was before. First, it happened during and after the Ukraine-Russia conflict, then for a short while in January 2020 when they introduced a new rule called IMO 2020. There was also a time from 2011 to 2013 when oil was really expensive, over $100 for one barrel. And in 2008, there was a quick spike when oil prices went above $150 for one barrel. The price increases before 2020 were because they used a dirtier type of fuel called high sulfur fuel oil (HSFO), which had more sulfur in it.

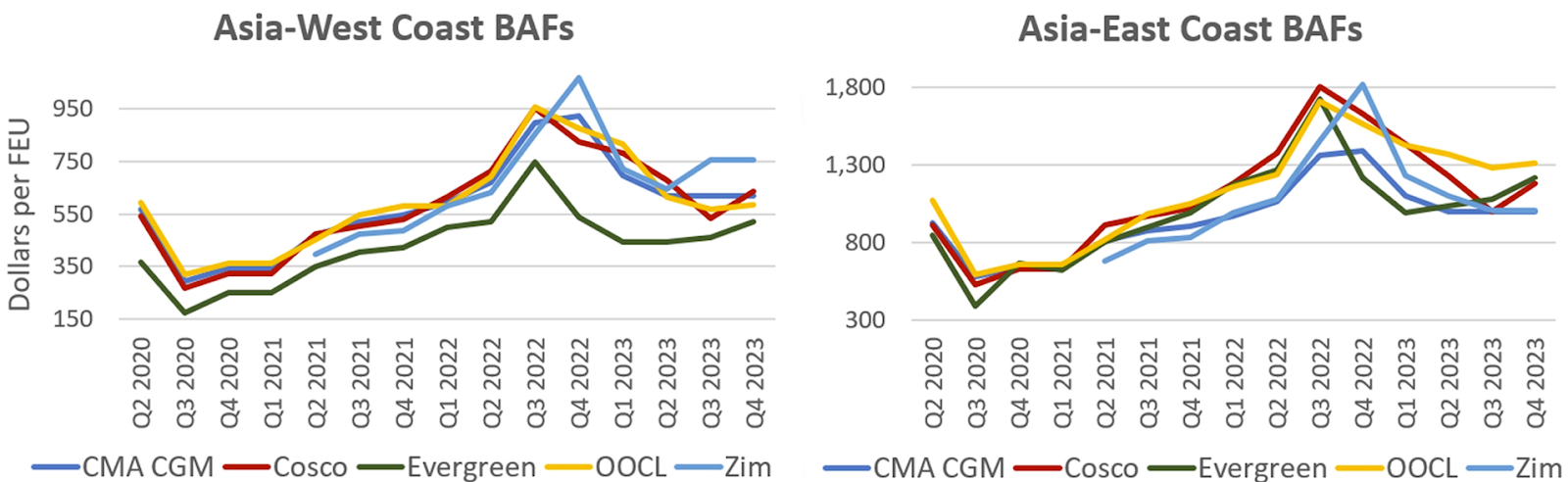

Now, the cost of the cleaner fuel called VLSFO is going up, and that’s making something called Bunker Adjustment Factors (BAFs) go up too. These BAFs are charges added by shipping companies. Some companies shared their BAFs through a group called Distribution Publications Inc (DPI), and they just released the BAFs for the last part of this year. Before this, the BAFs were going down from the end of 2022 to the middle of 2023 because the cost of VLSFO was going down from its high wartime prices. But now, the BAFs are starting to go back up again.

For the last part of 2023, the average BAFs for shipping announced by CMA CGM, Cosco, Evergreen, OOCL, and Zim (NYSE: ZIM) are about $623 for a special-sized shipping container in the Asia-West Coast route. That’s 6% more than what it was in the last quarter. Similarly, these five companies are charging an average of $1,142 for the same-sized container in the Asia-East Coast route for the last part of this year. That’s also 6% more than what it was in the third quarter.

With over 20+ years in the trucking insurance industry Cook Insurance Group combines national reach with local service to address the needs of large fleet, small fleet, single owner and tow trucking operations, and to charter bus lines. We ONLY serve the Trucking industry, providing the best trucking insurance. Let our friendly, bi-lingual staff help you find the right insurance protection at the right cost.

Cook Insurance Group is dedicated to meeting the needs of both small and large fleet trucking companies. Our reps handle every aspect of your program, ensuring you have the best trucking insurance plan for your specific needs. We work closely with you to manage your plan on an ongoing basis.

At Cook Insurance Group, we provide immediate certificate and ID card insurance, including 24/7 certificate availability. We leverage our client portal which allows you to access and issue certificates, check claim status and view policies. Cook Insurance Group is prompt and reliable, including 24-hr claims reporting. (Physical Damage and Motor Truck Cargo). We also provide educational seminars for management and drivers of companies.

At Cook Insurance Group we have licensed risk managers available to assist you with CSA scores and driver training. We provide border risk coverage (NAFTA) and mid-year loss run reviews.

Choose Cook Insurance Group for all of your trucking insurance needs whether you are located in Texas, Arizona or Arkansas.