Fewer Trucking jobs in May than in January

Earlier this year transportation jobs rose slightly until May. But recently have seen a downward revisions, seeing the net number of jobs in the sector decline. On Friday the Bureau of Labor Statistics reported that there were 1,609,200 seasonally adjusted jobs in the truck transport sector in May. At first glance this figure seems to be up 600 jobs from the April report. But the April report was later revised downward roughly 3,000 jobs from an original number of 1,612,500.

March was also revised downward to 1,607,600 jobs, from 1,609,500 jobs reported last month. The BLS posts an initial estimate for employment totals, and that number is subject to revision for the following two months. It then becomes final until the annual revision that comes with the report released in February.

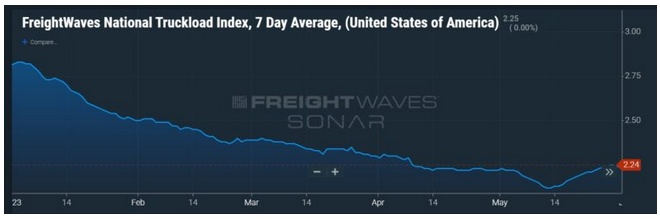

Based on the track record of multiple months having later revisions in March and April, it is very likely a revision will occur for the May report. The final figure for January barring any revisions next year would stand at 1,611,400 jobs. The latest report for May is 2,200 jobs less than that. For an industry that has gone through a collapse in spot rates of about 21% since the beginning of the year to a recent trough, a loss of just 2,200 jobs might look like a best-case scenario.

“Job growth in the trucking sector is demonstrating its persistent resiliency with jobs continuing to increase month over month,” Spencer said in an email to FreightWaves. But looking at the longer trend of a decline since January, job growth is “continuing to defy expectations given the declining truckload rate environment. … The long-term trend points to more of a plateau for trucking employment.”

David Spencer, Vice President of Market Intelligence at Arrive Logistics

“Truck capacity is holding up the market, slowing down the drop in employment that might come from the weak market. The combination of resilient jobs numbers and hours changes in line with other industries supports the capacity narrative, particularly when considering the improvement in the fluidity of freight transportation in much of the country”

Matt Muenster, Chief Economist at Breakthrough

Leading causes of low number of jobs in Trucking Transportation Industry

- Automation and Technological Advancements: The advent of automation and technological advancements, such as self-driving trucks, has the potential to reduce the demand for human drivers. While fully autonomous trucks are not yet widespread, ongoing developments in this field have raised concerns about future job prospects for truckers.

- Economic Downturns: Economic recessions and downturns can significantly impact the trucking industry. During economic downturns, there is typically a decrease in consumer spending, which directly affects the demand for goods transportation. When demand decreases, trucking companies may reduce their workforce to cut costs.

- Globalization and Outsourcing: The outsourcing of manufacturing and production to other countries has led to a decline in domestic freight transportation. As companies move their operations overseas, the need for long-haul trucking diminishes, thereby reducing job opportunities in the industry.

- Industry Consolidation: The trucking industry has experienced consolidation over the years, with larger carriers acquiring smaller companies. This consolidation has resulted in more efficient operations but has also led to job losses as redundant positions are eliminated or merged.

- Rising Fuel Costs: Fluctuating fuel prices can impact the trucking industry, as fuel costs constitute a significant portion of operating expenses. When fuel prices rise, trucking companies may face financial constraints and reduce their workforce to maintain profitability.

- Regulation and Compliance: The trucking industry is subject to various regulations and compliance requirements, including hours-of-service rules, safety regulations, and environmental standards. While these regulations are necessary for public safety and environmental protection, they can increase operating costs for trucking companies, potentially leading to job cuts or reduced hiring.

- Industry Perception and Attractiveness: The nature of trucking work, which involves long hours on the road, extended periods away from home, and physical demands, has made it challenging to attract new talent to the industry. A lack of interest in trucking as a career choice can contribute to a low number of job seekers, exacerbating labor shortages.

With over 20+ years in the trucking insurance industry Cook Insurance Group combines national reach with local service to address the needs of large fleet, small fleet, single owner and tow trucking operations, and to charter bus lines. We ONLY serve the Trucking industry, providing the best trucking insurance. Let our friendly, bi-lingual staff help you find the right insurance protection at the right cost.

Cook Insurance Group is dedicated to meeting the needs of both small and large fleet trucking companies. Our reps handle every aspect of your program, ensuring you have the best trucking insurance plan for your specific needs. We work closely with you to manage your plan on an ongoing basis.

At Cook Insurance Group, we provide immediate certificate and ID card insurance, including 24/7 certificate availability. We leverage our client portal which allows you to access and issue certificates, check claim status and view policies. Cook Insurance Group is prompt and reliable, including 24-hr claims reporting. (Physical Damage and Motor Truck Cargo). We also provide educational seminars for management and drivers of companies.

At Cook Insurance Group we have licensed risk managers available to assist you with CSA scores and driver training. We provide border risk coverage (NAFTA) and mid-year loss run reviews.

Choose Cook Insurance Group for all of your trucking insurance needs whether you are located in Texas, Arizona or Arkansas.